What about no?

A treatise on the upcoming budget

I know I usually write about cool tech companies (or nothing much recently) but I felt compelled to write about about the upcoming UK Budget

In Little Britain one of the sketches was of a truculent customer service agent, Carol, where no matter what anybody asked, her response was always the same: “Computer says no”.

Unless you’ve been hiding under a rock, you will know that there’s a Budget coming up and that tax rises are inevitable, inescapable, certain, pre-destined (pick your apocalyptic metaphor). There is a black hole to fill and despite poking the UK economy with a stick really hard and shouting at it to grow, it has singularly failed to comply with Rachel Reeves. So we know that taxes are going up - the only question is which ones and by how much.

But wait! What if Chancellor Reeves took a note out of Carol’s book and said no a little more? Maybe tax rises wouldn’t be inevitable. Maybe, instead, they’d evitable (if that’s even a word). Civil servants and their political superiors treat the expansion of government and the inevitable tax rises as an inexorable law of nature, not a series of conscious, reversible choices.

The UK’s budgetary problem comes down to a simple one of more money going out than coming in. And a big part of the problem is that successive Chancellor’s (not just Reeves)lack the moral confidence to say no. They won’t say no to the Pension Triple Lock despite it being on course to cost £15.5bn more than anticipated by 2029-20; they won’t say no to unions demanding pay increases; the won’t say no paying Mauritius £101m a year for 99 years to take the Chagos Islands off our hands; they won’t say no to their own party when it rebels against benefit reforms; Hell, they don’t even say no to schemes to encourage people to go to restaurants in the middle of a pandemic where the disease is passed indoors by people being near each other.

To be fair to Reeves, she did say no one time but the reaction was so ferocious that she and her boss shat the bed and U-turned pretty sharpish.

They should have stuck to their guns. And they should keep saying no until spending is under control. I get it, every day, people tell you how much more they need or their service will crumble. Just last week, we were told that the bottomless pit that is the NHS needs another £3bn. Not to worry, Rachel has agreed to an additional £50bn.

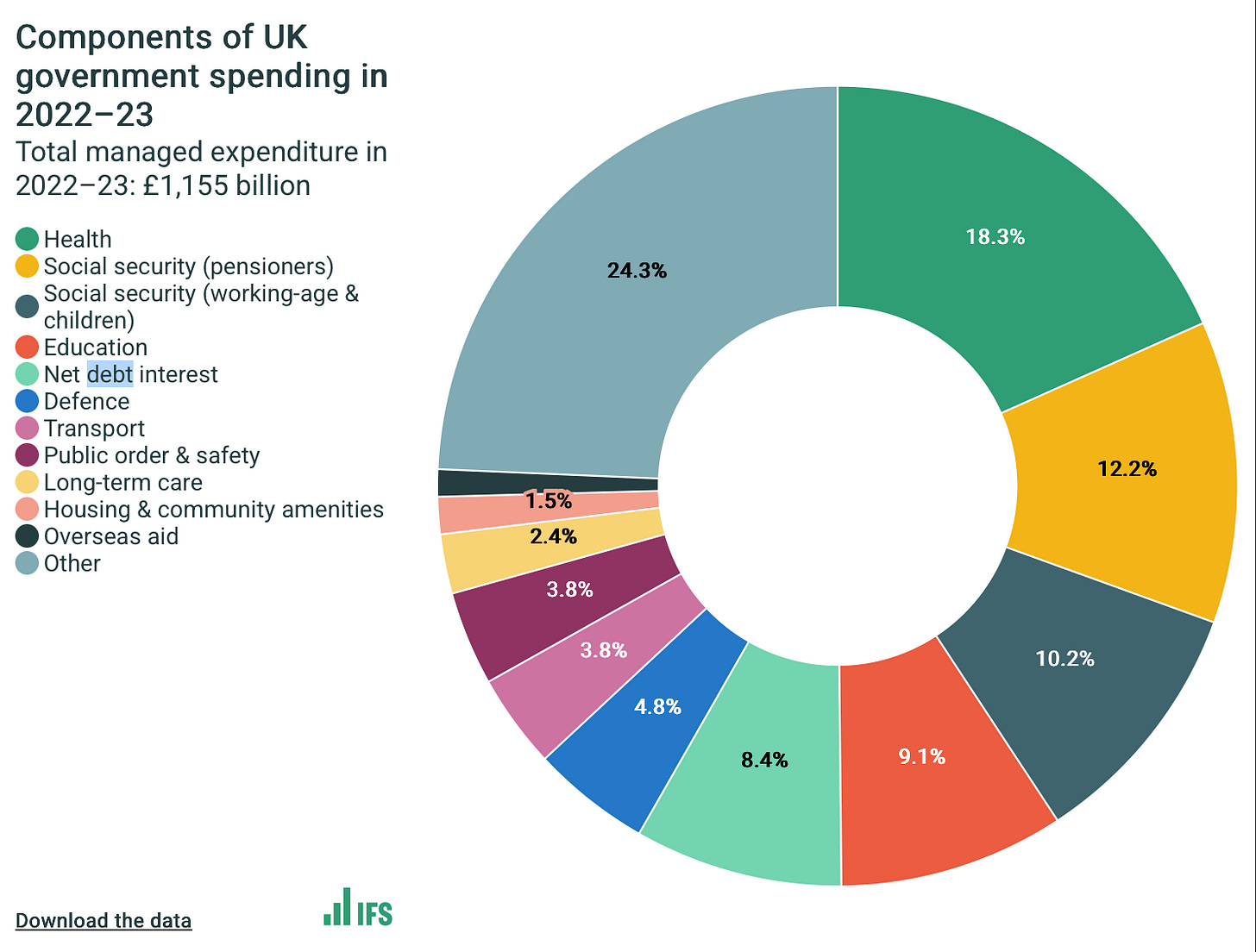

The national accounts increasingly resemble a pie chart of moral vanity: every sliver green, every constituency pacified, and the aggregate burden quietly transferred to those still productive enough to pay.

And the UK borrowing costs keep inching higher because the world is noticing.

So now we’re told that there may be a mansion tax, or a bigger tax on pensions or a tax on LLP’s or higher rates of income tax (breaking a manifesto promise), or an exit task on those leaving the country.

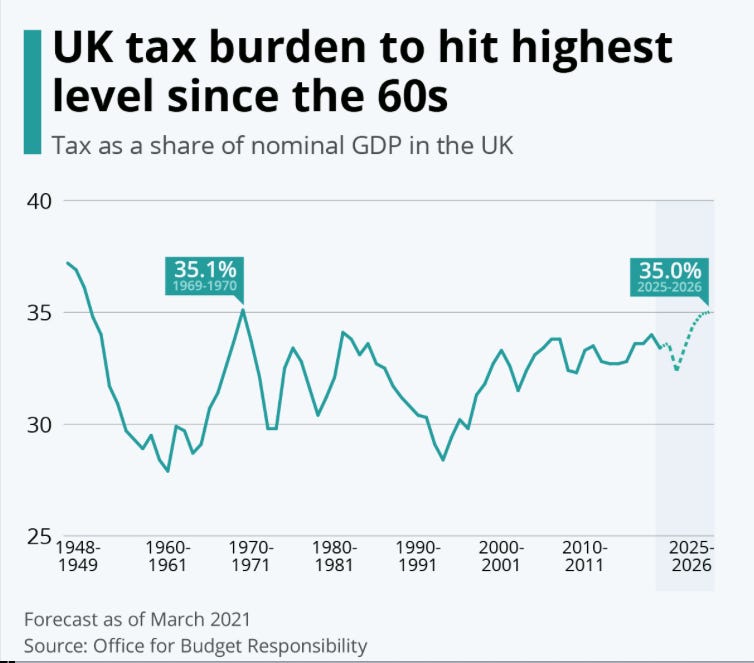

To be fair, this is likely some Treasury fearmongering so that when the actual tax rises come, we can be told they weren’t as bad as expected. But Reeves has been super clear - the wealthier will pay more. This is despite the tax burden being the highest it’s been since the 60’s and the top 10% of earners paying a MASSIVE 60% of all income tax, not to mention they will, naturally, also be the highest payers of VAT, Stamp Duty, CGT and inheritance tax.

And despite the aforementioned poking it with a stick, the economy just isn’t growing. In fact, productivity just had to be revised down so Reeves finds herself with an additional £20bn hole.

We’ve categorically failed to grow our way out of this black hole. So tax it’ll be. I mean, it worked so well with the National Insurance increase. These are people for whom the term “second order effects” produces a blank stare and a slack jaw. Notice their surprise at the inevitable happening after the imposition of VAT on private school fees.

I think the thing that stings most is that there is such easy low hanging fruit to try and boost growth but this government and their predecessors are doing so little of it that it is inevitable that this round of tax rises won’t be the last. And rather than just gripe, here’s a list off the top of my head of simple things (not even complex tax schemes) that any government could do to boost national growth:

Simplify the tax code. At 21,000 pages, the UK has the longest tax code in the world. Complexity that creates massive overhead on any business.

Remove stamp duty on trading shares - a healthy stock market is good for a country.

Reverse the stupid non-dom rule that led to an exodus of over 16,500 millionaires - entrepreneurs and value creators the lot of them.

Reduce VAT. It’s a tax on all consumption and is a stupid barrier to buying things for an economy that is so reliant on the consumer to drive growth.

Reverse the NIC’s hike - making it more expensive to employ people is one of the dumbest things a government has done when it’s trying to boost an economy.

Reverse whichever stupid law it was that means that store staff can be compensated for being paid less than warehouse staff. This law is a massive burden on large businesses.

Remove the ESG reporting burden for public companies. Nobody cares.

Whatever is coming in the Employees Rights Bill - just kill it. Now is not the time to be more over-burdening to businesses.

Kill Net Zero. You can’t be a rich, low energy country and at the moment, the UK has the most expensive energy in the world. Yes lets boost nuclear, renewables and invest in fusion companies but don’t add any levies or charges to make our energy even more expensive than it has to be.

OK, that’s 9 straight off the top of my head, pretty pain-free things that could be done. Not even discussing things like building infrastructure and planning changes that are in the works to make building easier.

Few of those now presiding over the British economy have ever risked their own capital, met a payroll, or navigated the bureaucratic labyrinth they so happily extend to others. They do not despise business so much as misunderstand it. For them, “the economy” is an abstraction to be tuned, not a living network of endeavour and risk. Thus, when the choice arises between curbing appetite and confiscating achievement, they inevitably choose the latter.

It was said of Margaret Thatcher that she possessed the rarest of political virtues: the ability to tell a clamorous interest group to grow up. If Chancellor Reeves aspires to that level of seriousness she might begin her Budget with two short, unfashionable syllables: No.

Sadly, I doubt it.

Oh I don't think for a second the press would like it but you need a strong leader to stand up to them. And to tell their parliamentary party and the public what needs to happen. I just don't think we have those leaders in any of the parties and we're just drafting off of successes built decades ago and for which there is no god given right that they will endure forever.

Hi Richard – thanks for the post, it gave me a good laugh. I agree with most of your points, though the first one somewhat glosses over just how mind-bendingly complex such a task would be. The real snag is that if you actually tried to pull it off, the bond markets would vomit all over it — and you’d be out of office faster than a lettuce wilts.

The only way you could fund cuts of that magnitude would be through equivalent spending cuts — which inevitably means taking a swing at Health or Social Security. You can imagine how the press (and half the country) would react. For what it’s worth, I’d be all for it — the triple lock is a farce, and the fact that the NHS consumes 7% of GDP while being allergic to innovation might help explain why productivity is in the gutter. Seven percent of our economy is effectively prohibited from improving productivity if it costs a penny more.